If the company had a stringent credit score policy in place, it may have averted this situation. While the direct write-off methodology may provide simplicity, it introduces a degree of unpredictability and inconsistency that can significantly influence financial ratios and evaluation. Stakeholders should train warning and look past the floor of monetary statements to know the true monetary situation of an organization employing this technique. To effectively implement the Direct Write Off Method, companies ought to adhere to sure greatest practices. Firstly, corporations should establish clear criteria for determining when an account receivable is deemed uncollectible. At the tip of the fiscal yr, the retailer’s accounts receivable steadiness is $100,000.

Inaccurate Financial Statements

- For entrepreneurs and small enterprise house owners, the simplicity of the direct write-off method holds vital enchantment.

- This technique, which entails expensing accounts receivable which are thought of uncollectible on to the earnings assertion, bypasses the allowance for doubtful accounts.

- Often this occurs many months after the credit score sale was made and is finished with an entry that debits Dangerous Debts Expense and credit Accounts Receivable.

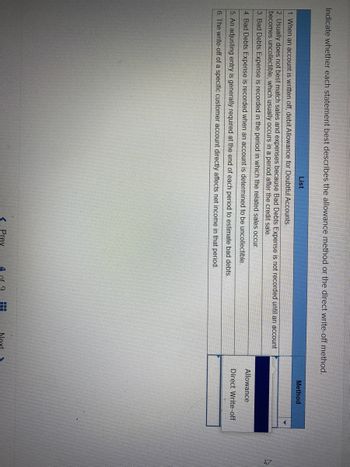

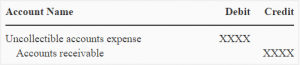

One important level is that the direct write-off methodology contravenes the matching precept. The matching principle requires the bills to be reported within the interval by which it is incurred. At the same time, the direct write-off technique states that the bad debt is reported when the debtors or the accounts receivables are written off, which may take a quantity of months after the sale has been made. The direct write off technique is a way companies account for debt can’t be collected from shoppers, the place the Bad Debts Expense account is debited and Accounts Receivable is credited. The direct write-off methodology is the best methodology to e-book and document the loss on account of uncollectible receivables, but it isn’t in accordance with the accounting rules. It also ensures that the loss booked is predicated on precise figures and never on appropriation.

In a world where money move is king, mastering unhealthy debt accounting and credit administration isn’t merely a monetary https://www.simple-accounting.org/ task however a strategic crucial. Companies that method this space with diligence, transparency, and a proactive mindset place themselves for sustainable success. Armed with the insights and best practices from this collection, you probably can confidently navigate the challenges of credit threat and construct a healthier, extra sturdy financial future. Furthermore, leveraging technology, offering cost incentives, and adapting credit score phrases in response to economic shifts empower firms to balance danger with growth opportunities. When unhealthy money owed do happen, dealing with write-offs professionally and exploring appropriate recovery avenues ensures monetary information stay accurate with out compromising customer relationships.

Firstly, the accounts receivable balance is decreased by the total amount of the uncollectible debt. The Direct Write Off Technique is often used in industries where bad money owed are relatively rare or have a minimal influence on monetary statements. If you’re a small enterprise owner who doesn’t often take care of unhealthy debt, the direct write-off method might be simpler. However the allowance method is more commonly preferred and sometimes utilized by bigger corporations and companies incessantly dealing with receivables. If you’re questioning which method is best for your small enterprise, communicate with a professional for insights into your specific situation.

To illustrate, contemplate a hypothetical firm, Zeta Inc., that opts for the direct write-off technique. In 12 Months 2, they write off $500,000 in unhealthy money owed, inflicting their revenue margin to plummet to 5%. This drastic change could alarm traders, regardless of the underlying business operations remaining constant. There are many advantages of direct write-off method, including simplicity, elevated efficiency, and write off the dangerous debts in then tax return. The direct write off technique doesn’t comply with the GAAP, or typically accepted accounting rules. The direct write-off method may be less complicated should you run a small business and don’t frequently cope with unhealthy debt.

However, this technique can be problematic as a result of it violates the matching principle of accounting, which states that bills must be matched with the revenues they helped to generate. Since unhealthy money owed are sometimes written off in a unique period than when the related gross sales occurred, this will lead to a distortion of each the revenue assertion and the steadiness sheet. This technique is most well-liked in conditions where the simplicity of recording precise losses outweighs the need for accurate matching of revenue and expenses. The alternative to the direct write off technique is to create a provision for unhealthy money owed in the same period that you simply acknowledge income, which relies upon an estimate of what dangerous debts shall be. This strategy matches revenues with expenses, so that all aspects of a sale are included within a single reporting interval. Therefore, the allowance methodology is considered the more acceptable accounting methodology.

Later, when a particular debt is determined to be uncollectible, the business writes off that quantity by debiting Allowance for Uncertain Accounts and crediting Accounts Receivable. This does not affect the income assertion on the time of write-off because the expense was already recognized during the estimation. This methodology is particularly helpful for businesses that function on a money foundation or have limited customer credit. If gross sales are sometimes paid upfront or shortly after delivery, there could also be little need for detailed projections. But when a shopper fails to pay regardless of repeated efforts, the enterprise can simply remove the unpaid invoice from its information.

Handling Unhealthy Debt In Several Industries

The future of monetary analysis lies in additional predictive and accurate methods of accounting for unhealthy debts, which may present a truer representation of an organization’s financial position and performance. From an accountant’s perspective, the direct write-off methodology might appear to be a practical resolution, particularly for smaller companies with minimal dangerous debts. It avoids the complexity of estimating allowances for uncertain accounts, thus simplifying the bookkeeping course of. Nevertheless, financial analysts often take concern with this method because of its potential to distort an organization’s financial health. The direct write-off method provides an easy, albeit typically much less well timed, approach to recognizing uncollectible accounts, making it appropriate for smaller businesses or these with minimal unhealthy debt publicity. Nonetheless, the broader image of dangerous debt administration extends nicely past accounting entries.

Discover Which Forms Of Businesses May Choose Each Technique Primarily Based On Their Particular Needs And Circumstances

In the realm of accounting, the Direct Write Off Technique serves as a crucial software for recognizing and recording bad debts. This technique permits companies to instantly write off the specific particular person accounts which may be deemed uncollectible, rather than estimating a common provision for doubtful money owed. Whereas the direct write-off method offers a straightforward approach to handle dangerous debts, it’s not the one method that companies can use. The allowance method provides an alternate that aligns extra intently with formal accounting standards and offers a more proactive method to recognizing uncollectible accounts. We will delve into the allowance technique, explaining how it works, its advantages, and why many businesses select this route despite its complexity.

On the opposite, the allowance technique requires the business owners to estimate the quantity which will be written off as unhealthy debt on the 12 months’s end. This estimated amount is then debited from the unhealthy debts accounts and is credited to the allowance for doubtful accounts. As per the direct write-off method, the business owners are required to write down off the precise sum of cash not obtained by the entity and which can be written off as bad debt. This makes it easier for small enterprise homeowners to follow this method of accounting. The direct write-off technique denotes an quantity in the books as bad debt only once it is found to be uncollectible.